Scams Targeting Homeowners After Closing

After buying a home, it’s common to start receiving official-looking letters or even phone calls about your new property. Many of these are scams designed to appear urgent and legitimate – but they have nothing to do with your lender or title company.

These notices may say things like “Final Notice,” “Immediate Response Needed,” or “Your Coverage Is Expiring”. They often use your real lender’s name and your property address to appear authentic.

Here’s what to watch for, how these scams work, and what to do if one shows up in your mailbox.

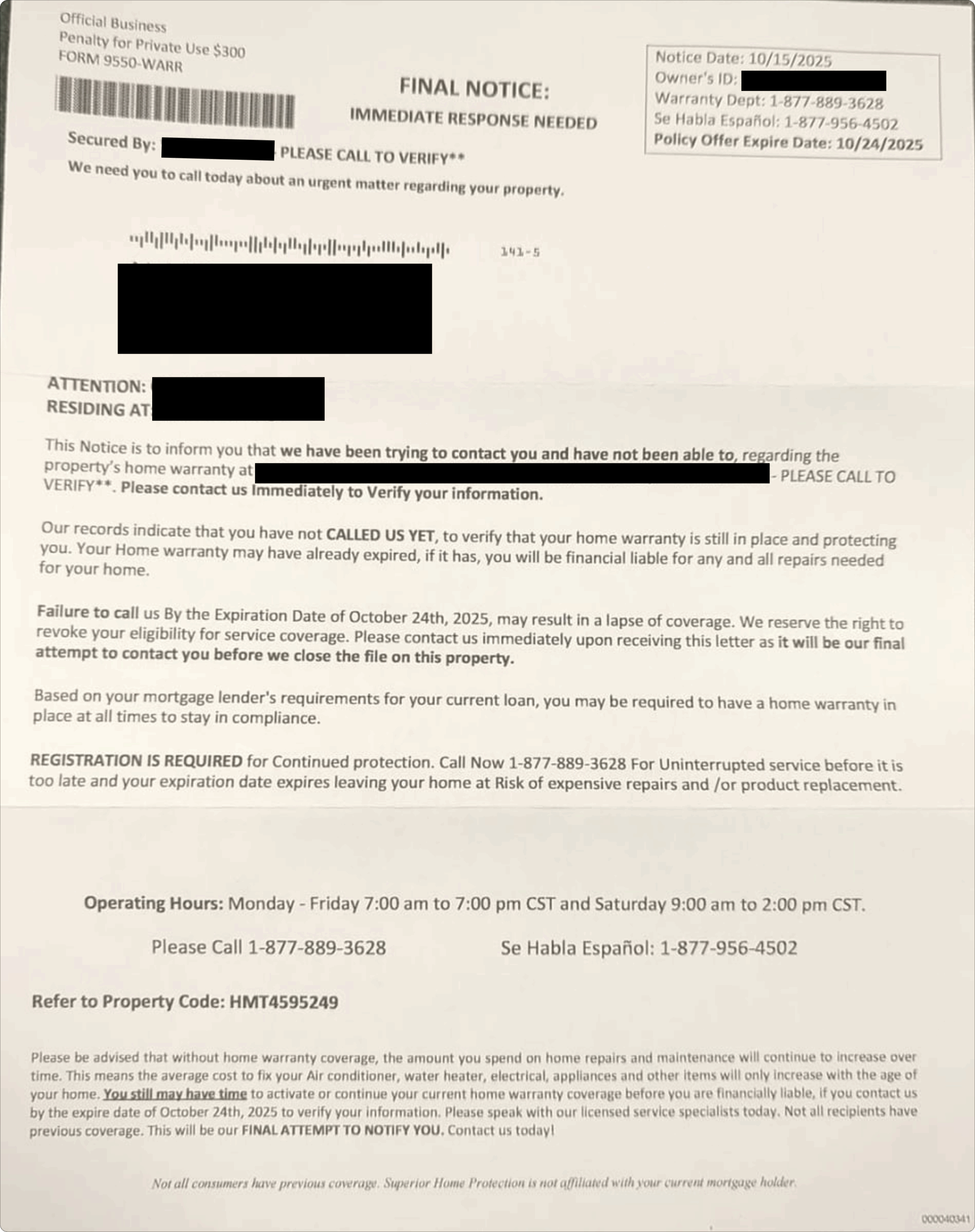

1. Your Home Warranty Is About to Expire

Shortly after closing, many homeowners receive letters warning that their home warranty is about to expire. These mailers look official, often mentioning your lender’s name (like “Secured by NewRez LLC”) and urging you to call immediately to “continue protection.”

📸 Example:

A letter arrives labeled “FINAL NOTICE” with bold text urging you to “Call Today to Verify.” It references your property address and even includes a fake expiration date for your “coverage.”

💡 Reality:

Your lender doesn’t manage home warranties. If you purchased one, it came directly from a warranty company, not your mortgage lender. These letters are designed to sell you an unnecessary or overpriced plan. You can safely ignore them.

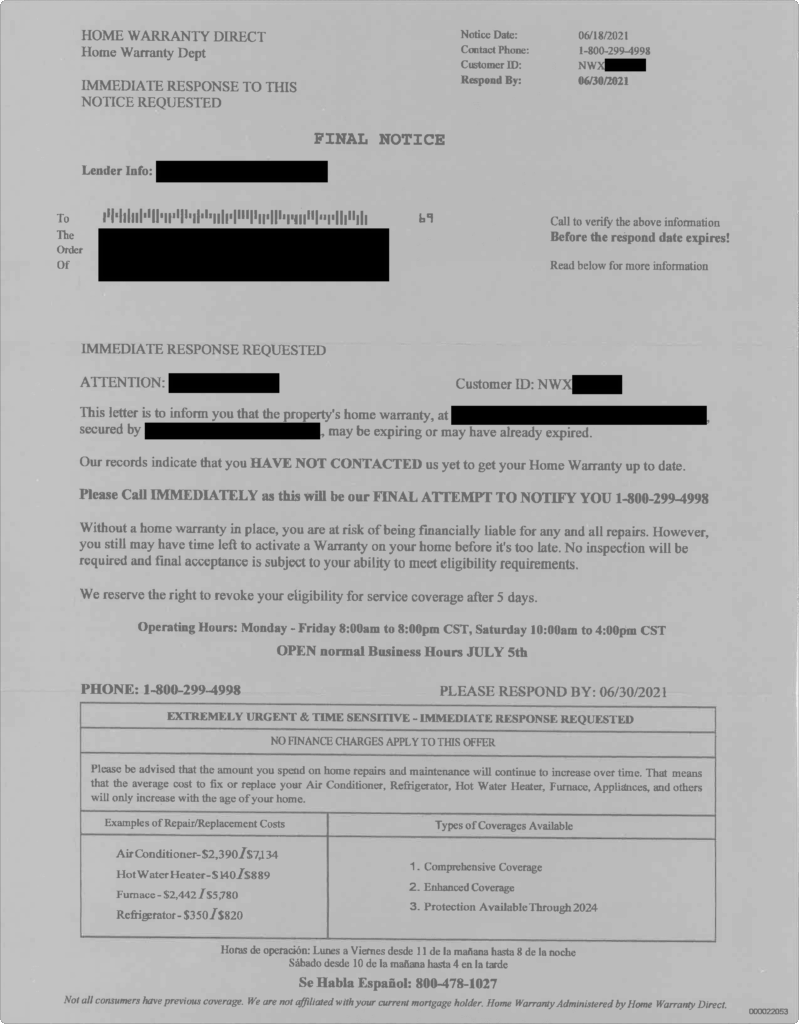

2. Mortgage Insurance or Protection Plan Expiring

Another common scam claims that your mortgage insurance or protection plan is expiring. These are typically disguised life insurance sales pitches.

📸 Example:

You receive a notice stating that your “mortgage insurance coverage is ending” and you must call to “keep your protection active.” The mailer may even display your real loan amount and closing date.

💡 Reality:

Your mortgage insurance (PMI or MIP) is managed solely by your lender or loan servicer. It can’t expire without formal written notice from them. These letters are not connected to your actual loan – they’re trying to sell you an unrelated “Life” insurance policy.

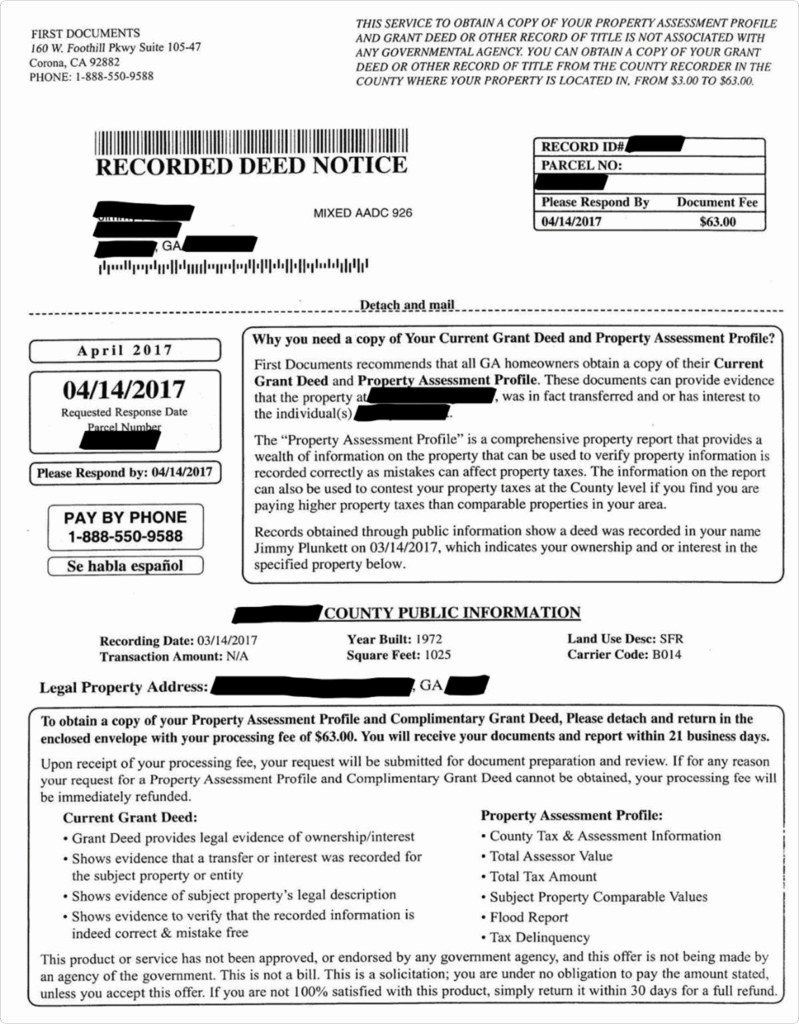

3. Purchase Your Home Deed

After closing, you might receive a letter that looks like an official government document offering to mail you a copy of your property deed – usually for $80 to $150.

📸 Example:

A mailer arrives with official seals or government-style formatting. It says, “You must register your deed” or “Act now to receive your official property document.”

💡 Reality:

You already own your deed. Your title company provides it after closing, and your county clerk or recorder can issue additional copies for free or a small fee. These companies are charging you for something you already have.

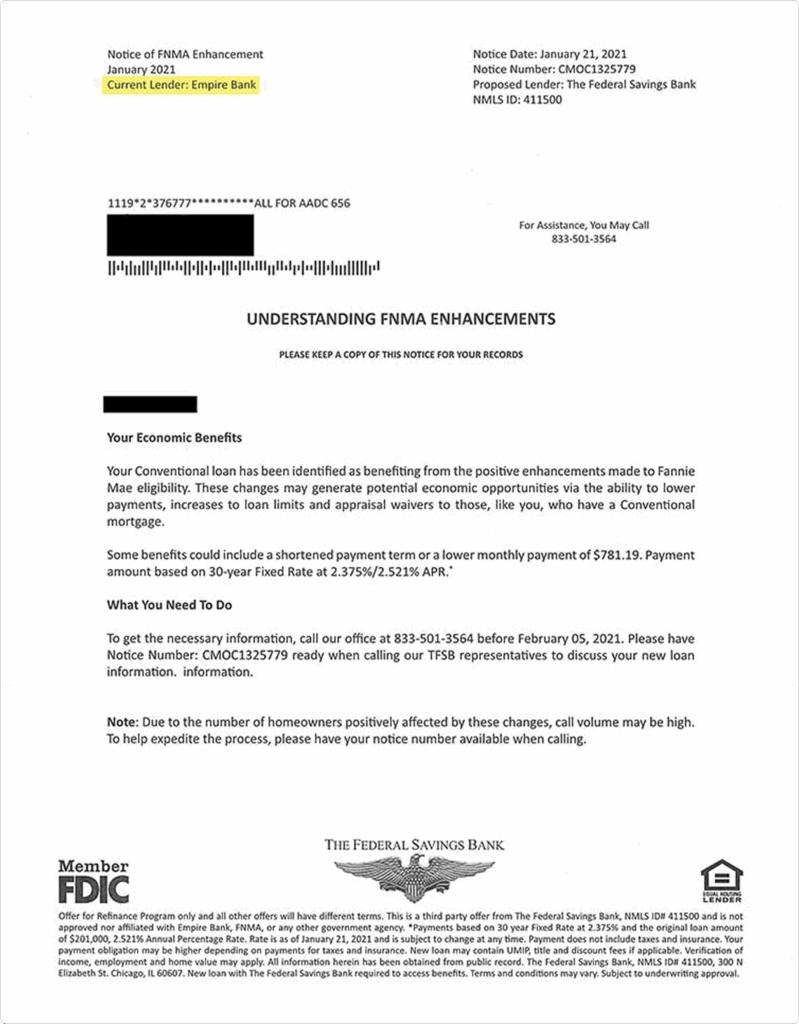

4. You Qualify for a Special Refinance Program

Scammers often send letters promising that you “qualify for a refinance” or “government relief program.” They use lender names, logos, and even public loan data to appear trustworthy.

📸 Example:

A letter says you “qualify for lower payments” or “exclusive refinance options” and instructs you to call immediately to secure the rate. It includes your current mortgage details to make it look real.

💡 Reality:

These are not legitimate refinance offers. They’re designed to collect your personal and financial information. Only your lender or a trusted mortgage advisor – like your UnrealFi loan officer – can confirm valid refinance opportunities.

How Scammers Get Your Information

When you buy a home, your sale is recorded with your county as a public record, including your name, address, and lender. Scammers regularly review this data to create mailers that look tailored to you — using real information to gain your trust.

That’s why many of these letters look personalized and even mention your lender or loan type.

How to Protect Yourself

Now that you know how these scams find you, here’s how to recognize them — and what to do if one ends up in your mailbox.”

Scammers rely on urgency, confusion, and familiarity — using your lender’s name or public home purchase details to make their letters look trustworthy. Here’s how to protect yourself and stay one step ahead:

1. Verify the Source Directly

If you receive any mail or call that references your mortgage, never respond using the contact information listed. Instead, contact your lender, title company, or UnrealFi loan advisor directly using the phone number or email you’ve used before. Real lenders will never pressure you to act immediately or disclose personal details over the phone.

2. Watch for Red Flags

Be cautious of mail that:

- Includes language like “Final Notice” or “Time Sensitive Material.”

- References your lender’s name but uses a different phone number or address.

- Asks for payment, personal information, or signatures.

- Includes typos, grammatical errors, or overly generic company names (like “Home Warranty Department”).

- Read the fine print, they often disclose in there that it is unrelated to your lender.

If anything feels off, it probably is.

3. Protect Your Personal Information

Never provide your Social Security number, bank details, or loan number to anyone who contacts you unexpectedly – even if they seem to have accurate details about your mortgage. Scammers often use partial public information to gain your trust.

4. Keep a Record of Suspicious Mail

Take a photo or save a copy of any questionable mailer. If you’re unsure whether it’s legitimate, share it with your UnrealFi loan advisor — they can confirm instantly whether it’s authentic or a scam. You can also report scams to the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC).

5. Use Caution with Online Searches

Some scammers run fake customer service numbers or “mortgage lookup” websites that appear at the top of search results. Always navigate directly to your lender’s website (for example, by typing the full web address yourself) instead of clicking ads or third-party links.

6. Know What Real Communication Looks Like

Your lender will contact you using consistent branding and secure channels. Legitimate communications will:

- Always include clear customer service information and account identifiers.

- Come from the same domain (e.g., @freedommortgage.com, @unrealfi.com).

- Never demand immediate payment or personal data.

Final Thoughts

Scams targeting new homeowners are unfortunately common – especially in the weeks right after closing. If you receive letters about your warranty, mortgage insurance, deed, or refinance eligibility, take a moment to verify before responding.

When in doubt, contact your UnrealFi loan advisor. We’ll help confirm what’s real and protect you from fraudulent solicitations.