Bank Statements vs. Transaction History: What’s the Difference, and Why It Matters for Your Mortgage

When applying for a mortgage, you may be asked to provide documents showing your banking activity. But not all financial records are created equal. Two commonly confused documents are bank statements and transaction history printouts. While both show what’s happening in your account, they serve very different purposes.

This guide breaks down the key differences, so you’ll know exactly what to provide and why it matters.

📑 What Is a Bank Statement?

A bank statement is an official monthly summary issued by your bank. It includes a snapshot of all transactions, like deposits, withdrawals, and transfers, over a fixed period, usually one month.

Key features of a bank statement:

- ✅ Official Document – Issued by your bank with their logo, branding, and legal format.

- 📆 Fixed Timeframe – Covers a full month (or sometimes quarterly).

- 💰 Summarized Activity – Includes your beginning and ending balances, totals for each transaction type, and all activity during that period.

- 📝 Used for Verification – Accepted by lenders, landlords, and tax authorities as proof of financial stability.

- 📄 Organized Format – Neatly structured and easy to read.

💡 Mortgage Tip: Lenders usually require the last 2–3 months of official bank statements during the application process.

📃 What Is a Transaction History?s

A transaction history is an up-to-date log of every transaction in your account. You can view it any time through your bank’s website or mobile app. It’s helpful for checking your recent purchases, transfers, and balances, but it’s not an official document.

Key features of a transaction history:

- 🔄 Real-Time Activity – Shows transactions as they happen, including pending items.

- 🗓 Flexible Timeframes – View any custom date range (e.g., last 7, 30, or 90 days).

- 🔍 Detailed Entries – Displays each individual transaction with merchant info, amounts, and dates.

- ✋ Not Official – It’s not accepted for legal or financial verification.

- 📥 User-Generated – You can download or print it as a CSV or PDF, but it lacks official bank formatting.

💡 Helpful for tracking your spending, but not for submitting with mortgage paperwork.

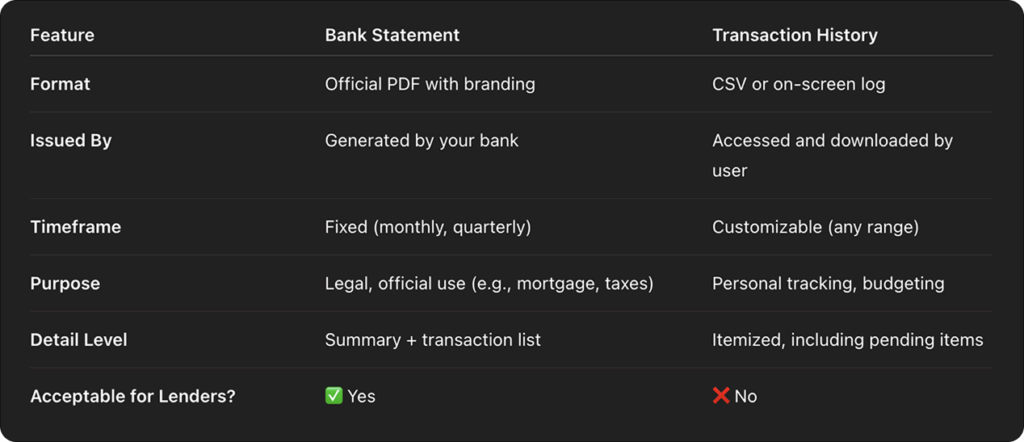

🔍 Side-by-Side Comparison

🏠 Why It Matters for Your Mortgage Application

When you’re applying for a mortgage, your lender needs official documentation that shows your financial stability—and that’s where bank statements come in.

✅ Bank Statements = Accepted by Lenders

Lenders want statements that clearly show your balance history, deposits, and spending, with the bank’s official format. This helps them verify your income, confirm assets, and check for red flags like overdrafts or large unexplained deposits.

❌ Transaction History = Not Accepted

While transaction histories are helpful for your own review, they don’t qualify as official documentation. They’re editable, often incomplete, and lack verification from the bank — so lenders can’t rely on them.

📌 Final Tips

- Always send full official bank statements—not screenshots or downloads from the transaction history page.

- Download statements directly from your bank’s website or app—usually from a section labeled “Statements” or “Documents.”

- If you’re unsure what to submit, ask your loan officer—they can help ensure your documents meet the lender’s requirements.

Need help accessing your bank statements from Bank of America, Chase, or Venmo? We have step-by-step guides ready to help. Just let us know!