Table of contents

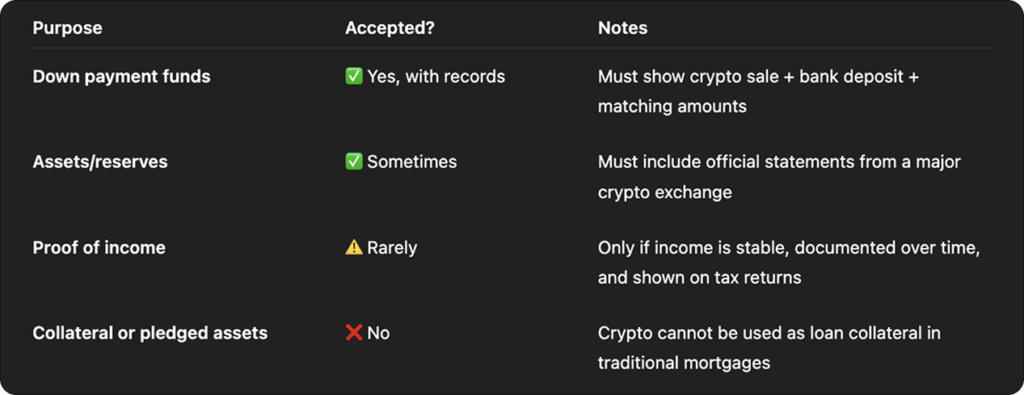

As crypto becomes more mainstream, many clients ask if they can use their cryptocurrency holdings—like Bitcoin or Ethereum—as part of their mortgage documentation. The good news is: yes, you can—but with conditions.

This guide explains when and how crypto documents can be used to support your mortgage application and what lenders typically expect.

What Crypto Documents Can Be Used

While crypto can’t be used as collateral in a traditional mortgage, certain types of documentation may be accepted to verify your assets, particularly if they were converted into cash for your down payment.

Here’s what most lenders will accept:

1. Exchange Statements

Most major platforms like Coinbase, Kraken, Binance, or Gemini allow you to download official monthly account statements in PDF format.

These usually include:

- Your full name and account details

- A summary of crypto holdings and balances (converted to USD)

- A record of deposits, withdrawals, and transfers

These documents are similar in structure to traditional bank statements.

2. Transaction History

You can also download transaction histories (CSV or PDF) from your exchange account, showing:

- Crypto buys/sells

- Fiat deposits or withdrawals

- Transfers between wallets

This helps show the movement of funds and proves that your assets are real and active.

3. Proof of Crypto-to-Cash Transfers

If you sold crypto and used the proceeds for your down payment or closing costs, lenders will likely ask for a clear trail:

- A record of the crypto sale on your exchange (with date and amount)

- A matching bank deposit showing the transferred funds

- Corresponding dates and amounts on both documents

This paper trail helps verify your source of funds.

⚠️ What NOT to Submit

Lenders will generally not accept the following as sufficient documentation on their own:

❌ Blockchain explorer links or public wallet addresses

❌ Screenshots of self-custody wallets without verified ownership

❌ Crypto held in cold storage with no exchange statements

❌ Crypto assets as collateral

While you may own these assets, they don’t meet traditional verification standards unless tied to traceable, exchange-based records.

How Lenders View Crypto in a Mortgage Application

Tips to Strengthen Your Crypto Documentation

- Use well-known exchanges that issue downloadable PDFs or official reports

- Make sure your name and account number are visible

- Provide full documentation, not partial screenshots

- Keep a clean paper trail from crypto sale → bank deposit → down payment

Need Help Gathering Crypto Docs?

We’re here to help! If you’re planning to use crypto as part of your mortgage documentation:

- Let your loan officer know early

- Gather full statements (PDF or CSV) from your exchange

- Document any cash-outs clearly with matching bank records

If you’re unsure what your exchange offers, we can help walk you through downloading your statements.

Let us know if you’d like help reviewing your documents. We’re committed to making your mortgage journey smooth — even if it’s a little more digital.