Homebuyer Education Course / Certification: What It Is and Why It Matters

Thinking of buying your first home? That’s a big milestone — and you don’t have to go through it alone. If you’re using a mortgage backed by Fannie Mae or Freddie Mac, there’s a good chance you’ll need to take a homebuyer education course.

But don’t worry — this course is designed to help, not hinder. It gives you tools to make smarter financial decisions and prepares you for the journey of homeownership.

Here’s everything you need to know.

✅ What Is a Homebuyer Education Course?

A homebuyer education course is an online or in-person class that teaches you the basics of buying and owning a home. It covers things like:

- How to budget for a home

- Understanding your mortgage

- The loan application process

- Responsibilities of homeownership

- How to avoid foreclosure

Most first-time buyers who use mortgage programs from Fannie Mae or Freddie Mac are required to complete one of these courses. And even if you’re not required — it’s highly recommended.

🏛️ Why Do Fannie Mae and Freddie Mac Require It?

Fannie Mae and Freddie Mac are government-sponsored enterprises (GSEs) that help make homeownership more accessible. They don’t lend money directly, but they buy and guarantee mortgages from lenders — which helps keep costs lower for borrowers like you.

These agencies require homebuyer education because it helps protect you, the buyer, from making costly mistakes. In fact, studies show that homeowners who take these courses are more likely to stay current on their loans and avoid foreclosure.

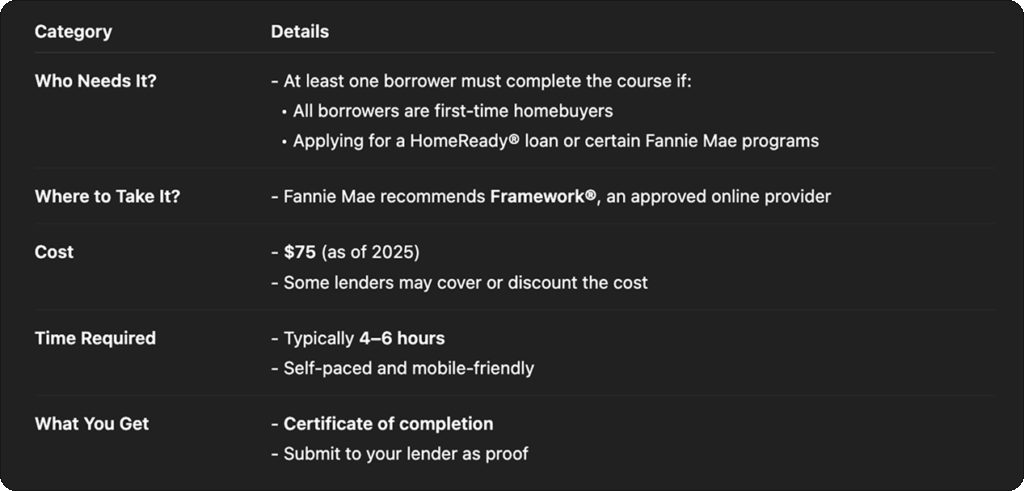

📘 Fannie Mae’s Requirements

If you’re applying for a mortgage backed by Fannie Mae (for example, a HomeReady® loan), here’s what you need to know:

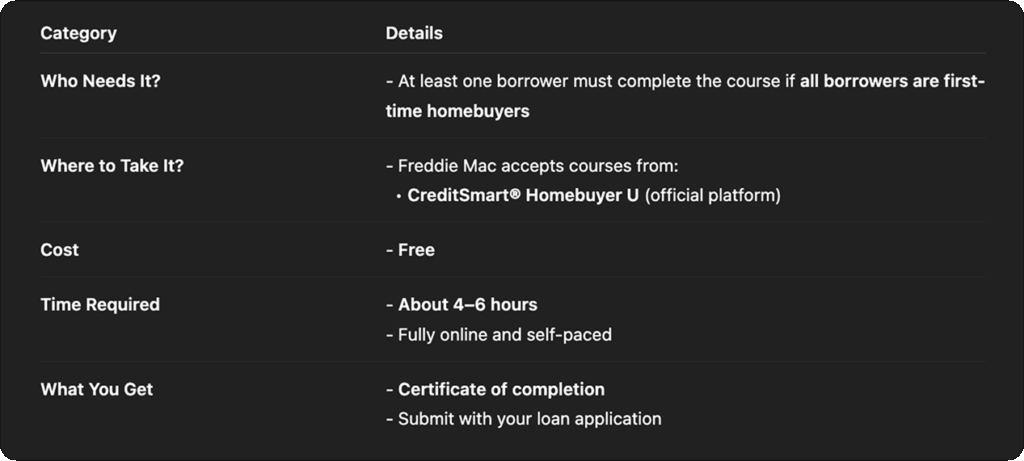

📘 Freddie Mac’s Requirements

If your mortgage is backed by Freddie Mac (for example, a Home Possible® loan), here’s what applies:

💡 Why You Should Take the Course (Even If It’s Not Required)

Even if your loan type doesn’t require it, a homebuyer education course is still a smart move. Here’s why:

- Learn how to budget for a mortgage and ongoing home expenses

- Avoid common first-time buyer mistakes

- Understand how credit and debt affect your loan options

- Get clarity on closing costs and paperwork

- Reduce the risk of missing payments later on

Think of it as a way to go from “homebuyer hopeful” to “homeowner ready.”

📝 How to Get Started

1. Ask your loan officer or mortgage advisor if your loan program requires homebuyer education.

2. Choose the right course based on whether your mortgage is through Fannie Mae or Freddie Mac.

3. Register and complete the course at your own pace.

4. Download your certificate and share it with your lender before closing.

Final Thoughts

Buying a home is one of the biggest financial decisions you’ll ever make — and you deserve to feel confident every step of the way.

A homebuyer education course isn’t just a checkbox — it’s your foundation for success.

If you’re not sure which course is right for your loan type, or if you need help registering, we’re here to guide you. Just reach out to your mortgage advisor or contact us anytime.

Let us help you become a homeowner — not just on paper, but in confidence, too.