How to Sign Initial Disclosures with NexBank

If your lender is NexBank, you’ll receive your Initial Disclosures electronically through DocMagic — a secure platform that lets you review and sign important loan documents online. This fast, paperless process helps you keep your mortgage moving without the need to print or mail anything.

Here’s exactly how to complete your e-signing from start to finish.

Step-by-Step: How to Sign Your Initial Disclosures with NexBank

1. Check your email

Look for an email from DocMagic inviting you to sign your Initial Disclosures.

Click the secure link in the message to open your disclosure package.

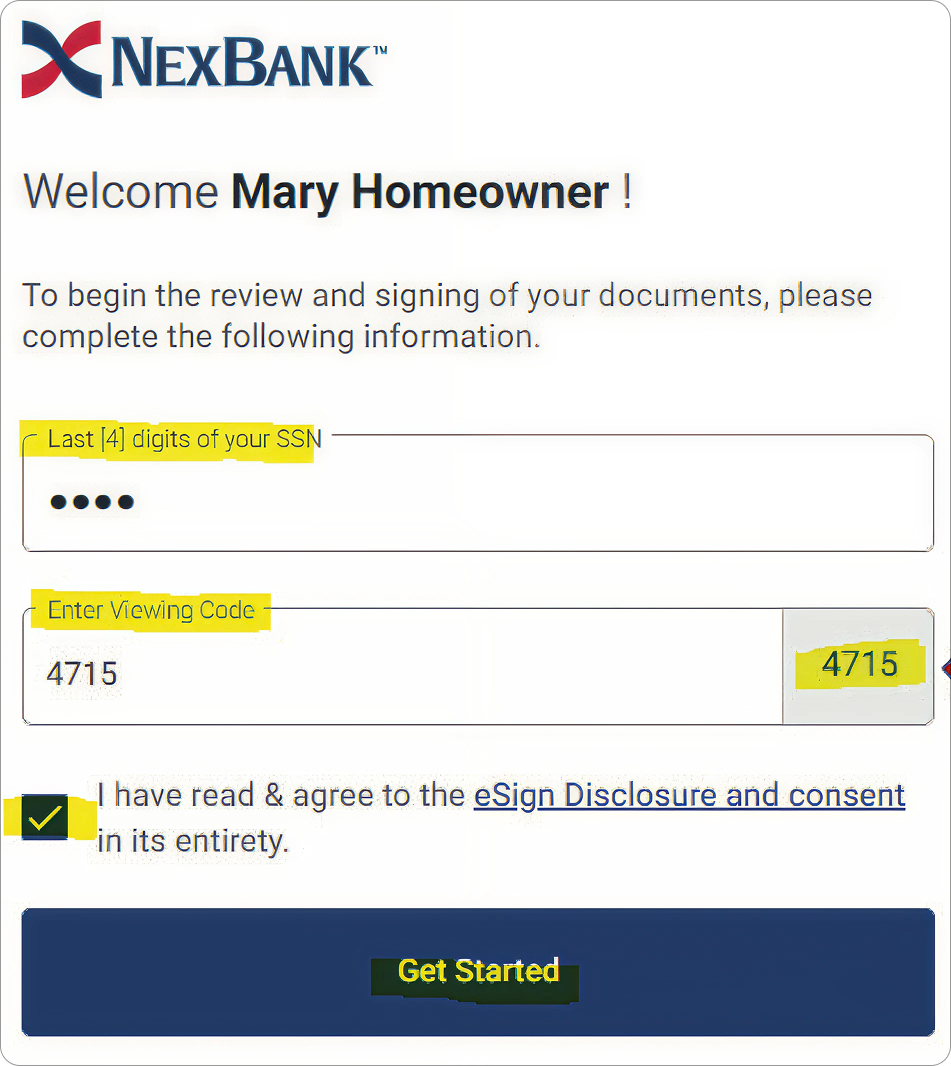

2. Enter your viewing code

When prompted, enter your unique Viewing Code to access your documents.

Note: The viewing code provided in the email is specific to your loan and borrower account.

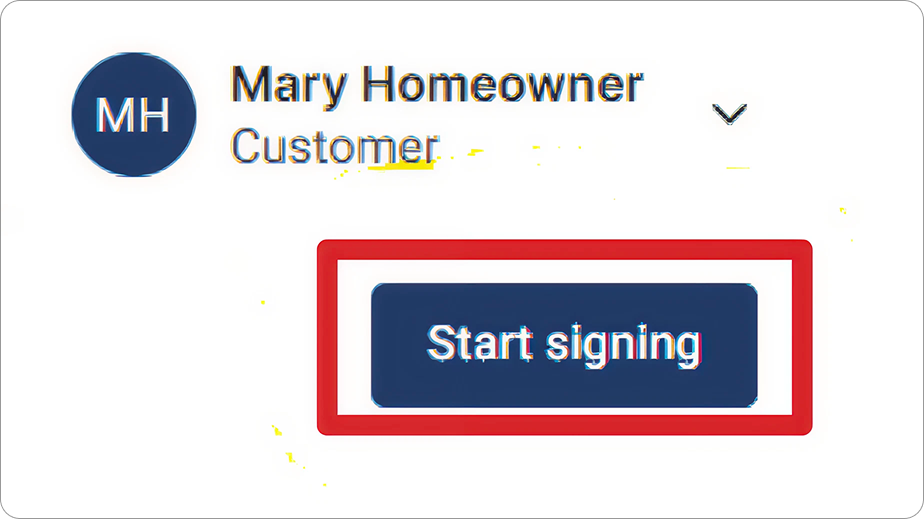

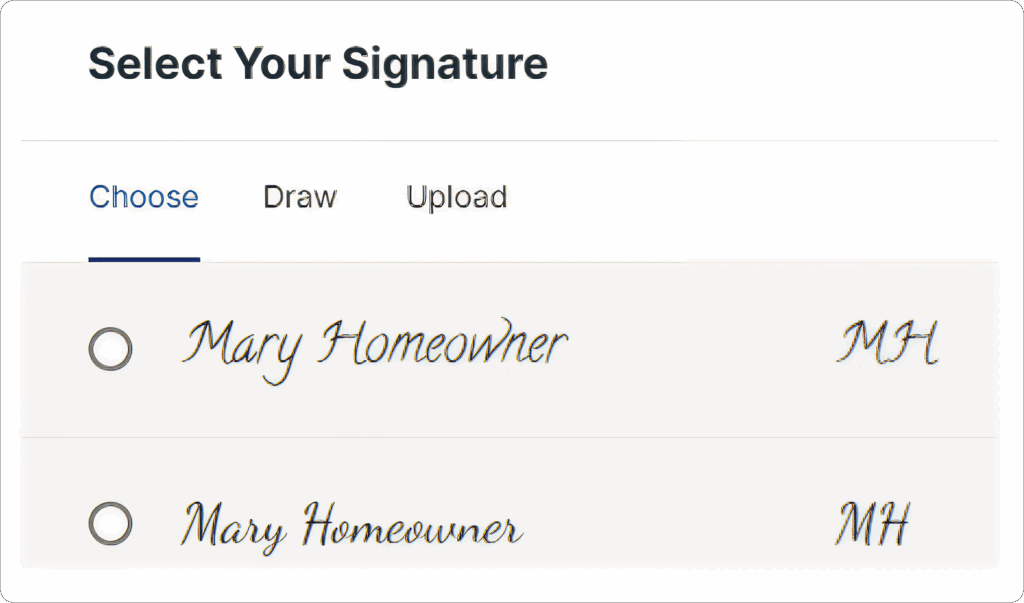

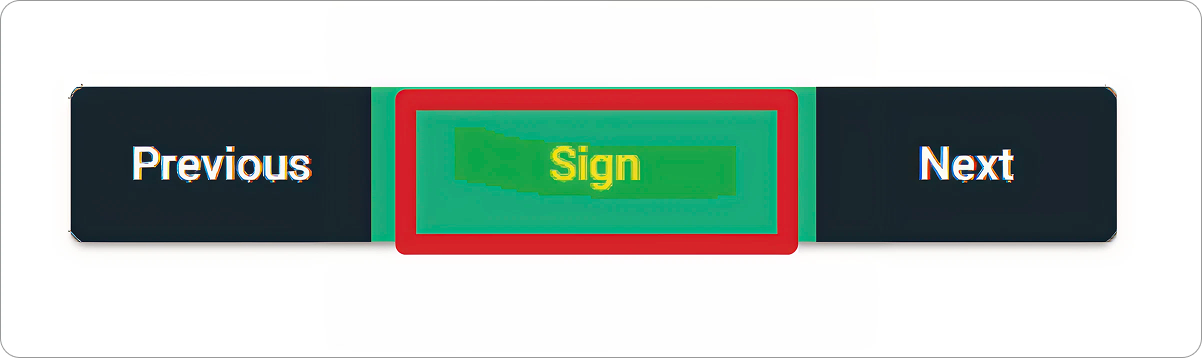

3. Review and sign each disclosure

Once your documents open, follow the prompts on screen.

Click on each highlighted signature field to apply your electronic signature.

4. Complete all documents

Continue signing each disclosure in order. The system will guide you automatically from one required signature to the next.

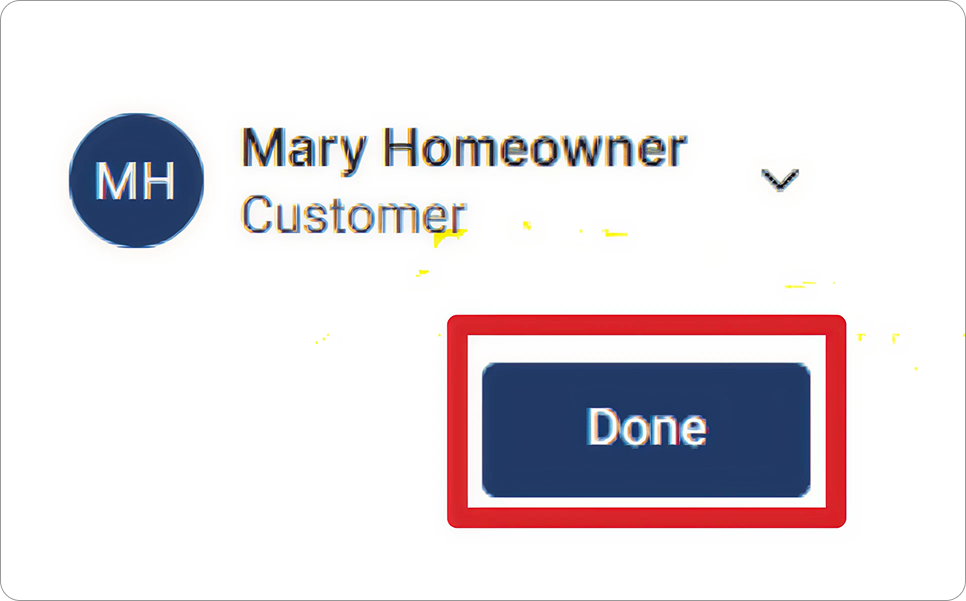

5. Click Done to finalize

After all documents are signed, click DONE to complete the process.

⚠️ Important: The e-sign process will not register as complete until you click DONE. If you exit early, your disclosures will show as unsigned in your loan file.

Tips for a Smooth Signing

- Have your Viewing Code ready — you’ll need it to access your disclosures.

- Use a compatible browser (Chrome, Safari, or Edge) for best performance.

- Only borrowers listed on the application can sign electronically.

- If you encounter any issues opening your documents, check your spam or junk folder for the DocMagic email.

Final Thoughts

E-signing your NexBank Initial Disclosures through DocMagic is quick, secure, and convenient. Once completed, your signed documents are automatically delivered to your loan officer to move your mortgage forward without delay.

If you have any questions or experience technical issues, your UnrealFi loan advisor is ready to help.